Where are You Getting Your Financial Advice?

Making financial decisions—on investments, superannuation, insurance, estate planning, debt, retirement—often involves long-term consequences. Poor advice can cost far more than fees: it can erode savings, expose you to risk you didn’t understand, or trap you in unsuitable financial products. Conversely, good advice aligned with your situation can help you grow wealth, minimise tax or fees, protect against downside, and improve confidence and wellbeing.

Here are some concrete impacts:

- Financial loss when advice is driven more by commission or product-sales rather than by what’s best for you.

- Wasted opportunity when advice doesn't factor in your full situation, so you miss better options.

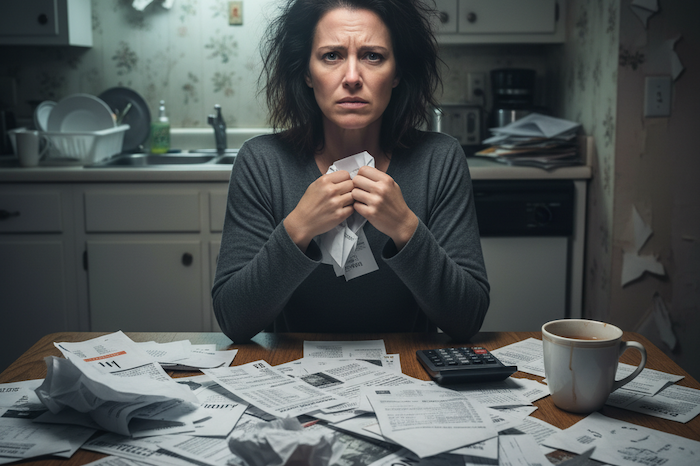

- Regret and stress when promised outcomes don’t materialise, undermining trust in advice altogether.

So getting advice that is qualified, ethical, transparent, and tailored to your needs isn’t just nice — it’s essential to safeguarding your financial future.